As I’ve repeatedly stated, I have a constant exposure to the Western media narratives on the “dire” situation in Russia. For years, we have repeatedly seen that their prognostications of Russia’s collapse turn out to be incorrect, but that doesn’t stop them from continuing to indulge themselves in this delusion. Lately, I’ve seen that certain topics are being regurgitated, and the new hope expressed by the West is that Ukraine may prevail if they can just continue dying in the trenches for another year. In this article, I will discuss the three most common arguments and explain why they are mistaken.

The first argument presented is that Russia’s National Wealth Fund is running out of money, and that the Russian government will essentially be bankrupt by the end of 2025. This is based on an analysis by Western economists who point out that only $54 billion in LIQUID assets remained in Russia’s NWF at the beginning of 2024. According to their math, Russia will run a $34 billion dollar deficit this year, or 1.7% of GDP, which is higher than the $20 billion deficit that Russian leadership originally projected, and this will leave only $20 billion in the NWF for next year. As a result, the Russian government will be forced to reduce spending, end the Special Military Operation, and retreat from the Ukraine. The problem with this assumption, for them, is that Russia sells about $10 billion worth of government bonds at auction each year. Therefore, the reduction in the NWF for the year 2024 will likely be $24 billion, leaving $30 billion for the year 2025. Last year, the deficit projection for 2025 was $10 billion, and if we assume, for the sake of argument, that next year’s budget gap is underestimated by the same amount ($14 billion), the likely total deficit will be $24 billion. If the Russian government succeeds in selling the same dollar amount in bonds to finance the 2025 deficit, then $14 billion in liquid assets will have to be sold off to finance their budget gap for the year. This will leave $16 billion in liquid asset value left in the fund going into 2026. Therefore, assuming a similar level of bond sales in 2026, the Russian government can theoretically afford to run a total deficit of $26 billion, or 1.3% of GDP, if they need to, in that year. Instead of a collapse of Russian finances in 2025, we see that the Russian government can continue to spend an amount of money similar to this year, each year, THROUGH 2026, or for the next 24 months. (Will there still be an Armed Forces of Ukraine left in another 24 months?)

I must stress here that I’m not saying that any of this WILL happen. I’m just trying to present the scenario to help people understand what COULD happen and what I believe is more likely to happen than a bankruptcy of the Russian nation. The leaders in the Russian government are not stupid people. They did not get to their position in life by being dumb.

Moving on to a more recent example of wishful thinking that I’ve seen, there is a new claim that Russia is facing an impending famine! One can admit that 2024 has been difficult for Russian farmers relative to the past two years. A combination of droughts, floods, and poorly timed frosts all contributed to a decline in Russian agricultural output this year going into the next, but things are not nearly as dire as suggested by the Western press. So, let’s investigate some numbers.

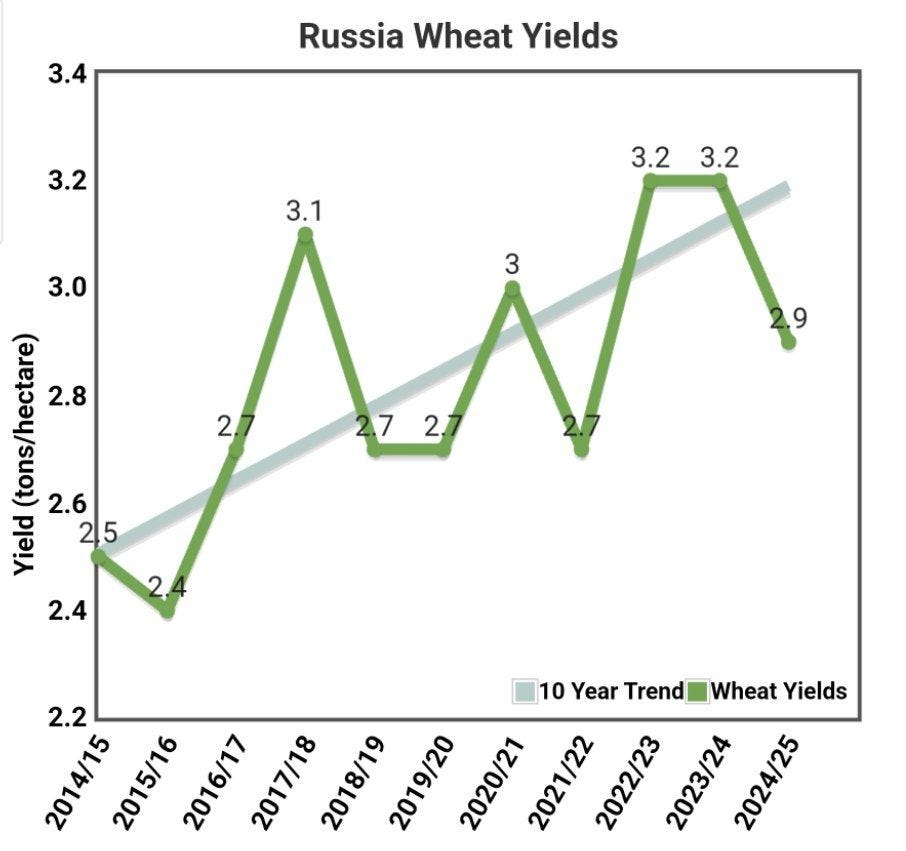

Across the board, the production of various crops in the Russian Federation is down 20% to 30% compared to 2022 and 2023. However, one must keep in mind that Russian agricultural output has increased dramatically over the past decade, so this is not as bad as it at first appears. Using numbers from the USDA Foreign Agricultural Service, I calculated the total tonnage of eight relevant cash crops. After I did that, I searched elsewhere for numbers on potato production so that I could include them in the analysis.

In all, I calculated the annualized average of five years of production for wheat, rice, barley, corn, millet, soybean, sunflower seed, and rapeseed between the 2014-2015 harvest and the 2018-2019 harvest then I added in the total tonnage of the 2016 potato harvest to this total. Without going into too many numbers to bore you, the total annualized average taken across five years of production for all of these crops combined came to 141,425,000 tons. The total for the harvest year (updated projection) of 2024-2025 (for all nine combined) is 148,485,000 tons, or about a 5% INCREASE over the average annual output between 2014 and 2019. Remember, this was a “catastrophic” year for Russian agriculture. A perfect storm of natural disasters and other unfortunate events. And production is still 5% higher than it was a decade ago.

For further perspective, The Russian wheat harvest in 2024-2025 alone is projected to be 15% higher than it was in 2016. 2016 is relevant, because it is the year that Russia became the largest wheat exporter in the world. And in a “catastrophic” year, Russia’s wheat output is still significantly higher than it was less than a decade prior.

For the final Western fixation that I’ll discuss, there are the constant Western predictions of the collapse of the ruble. This year, the ruble has indeed fallen in value on international markets, but this is largely a policy choice of the Russian government. In October 2023, the government increased the required amount of foreign receipts that the 43 major exporters of Russian commodities must repatriate into domestic currency to 80%, meaning that foreign currency would be sold for rubles thus increasing the value of the Russian currency on the market. However, due to the relative stability of the ruble that was achieved, this requirement was first reduced to 60% and then 40% in two decisions during June and then July of this year. The requirement could be increased again in an emergency, but the government has decided that they are comfortable with around a 100 ruble to the dollar exchange rate.

Ultimately, the ruble has fallen from 90 to 103 rubles to the dollar this year, just under a 12% decrease in value. This year, real wages in Russia are expected to increase by over 9% after inflation is accounted for. This is something that most western workers can only dream about. The inflation rate in Russia is projected to be just under 9%, meanwhile the Western ally in the region, Turkey, is currently experiencing an inflation rate of 48%, and the value of the of the Lira has fallen by nearly 20% in a year. (In fact, the Lira has lost nearly 80% of it’s value in the past 5 years!)

That’s enough for today but keep all of this in mind when you read the many Western articles proclaiming that Russia is almost out of money and about to collapse if the Armed Forces of Ukraine can avoid completely dying out for just one more year. There is no impending bankruptcy, and there is no great famine of 2025. Russia will be strong for years to come. Sure, the Russian Federation is facing some recent obstacles. A combination of bad luck and geopolitical forces continue to weigh on the Russian economy. Still, the problem that the Russian leadership has right now is not one of avoiding collapse, but rather maintaining a growing, resilient economy, and that’s a good problem to have.